About Us

NSKFDC is implementing various loan and non-loan based schemes. Under Loan based schemes, NSKFDC provides financial assistance to the Safai Karamcharis, Scavengers and their dependants for any viable income generating schemes including sanitation related activities and for education in India and abroad.

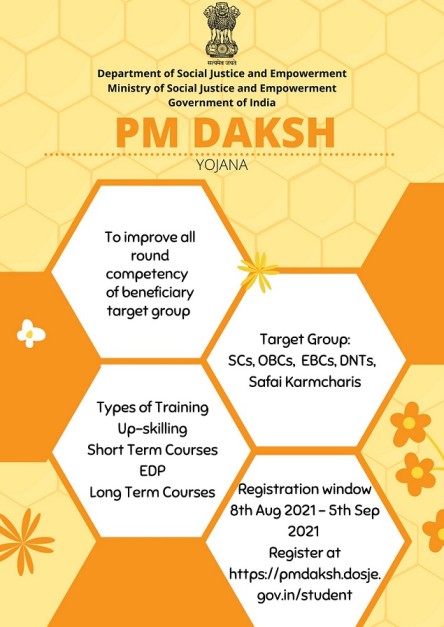

Under non-loan-based schemes, 100% grant support for skill-based training programmes implemented under Central Sector Schemes is provided. These programmes include provision of a stipend per candidate, as per approved guidelines. Further, support is provided for conducting Awareness Camps.

The schemes/programmes of NSKFDC are implemented through various State Channelizing Agencies (SCAs) nominated by the State Govts./UT Administrations, Regional Rural Banks (RRBs) and some Nationalised Banks. The financial assistance is provided at concessional rates of interest to the SCAs/RRBs/Nationalised Banks for onward disbursement to the target group of NSKFDC.